The on-chain analytics firm Santiment has revealed how Shiba Inu and XRP are among altcoins that are seeing a bullish divergence on the MVRV Z-Score.

MVRV Z-Score Says XRP And Shiba Inu Traders Are Seeing Losses Currently

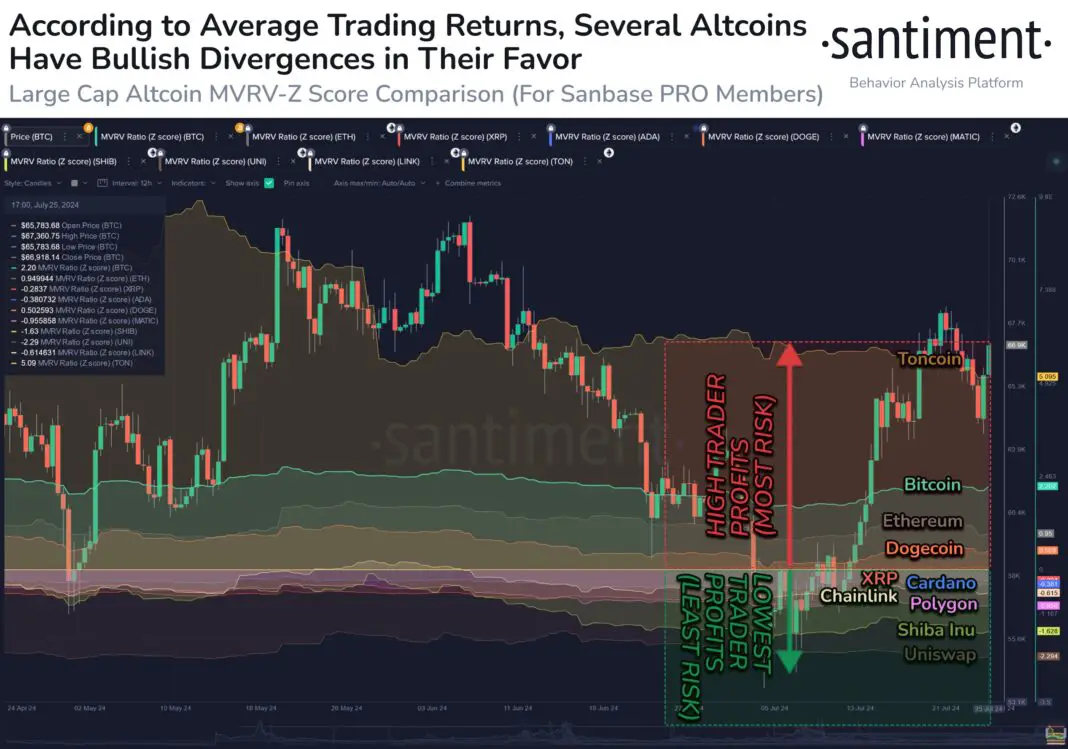

In a new post on X, Santiment has discussed how the various top coins in the cryptocurrency sector look on the MVRV Z-Score. The “Market Value to Realized Value (MVRV) ratio” is a popular indicator that, in short, measures the deviation between the total value held by the investors of an asset (that is, the market cap) and what they used to purchase it (the realized cap).

When the value of this indicator is positive, it means the holders of the given coin as a whole are currently holding net unrealized profits. On the other hand, the metric being below zero suggests the dominance of losses in the market.

Now, here is the chart shared by the analytics firm that shows the trend in the MVRV Z-Score for different top assets by market cap over the past few months:

As displayed in the above graph, Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and Toncoin (TON) are all currently in the positive territory of the MVRV Z-Score, suggesting that their average traders are currently enjoying profits.

At the same time, XRP (XRP), Cardano (ADA), Shiba Inu (SHIB), Chainlink (LINK), Polygon (MATIC), and Uniswap (UNI) are witnessing their investors carrying a higher unrealized loss than profit.

Generally, the investors in profits are more likely to sell their coins, and the likelihood of this profit-taking only increases with more gains they hold. As such, a high MVRV Z-Score has historically led to tops for any cryptocurrency’s price.

Of the four assets in positive territory of the indicator right now, Toncoin has the indicator at the highest level, suggesting that a selloff due to profit-taking could be probable for it.

In the case of the coins inside the negative region, their prices could see a bullish outlook instead, as there may not be many sellers left for them now. Shiba Inu and Uniswap are particularly seeing the most deviation between the market and realized cap.

“If you believe markets are about to surge, history says that buying into assets that traders have experienced the most pain in have a greater probability of netting high returns for you,” notes Santiment. As such, coins like SHIB may be offering the best buying window right now, according to the MVRV Z-Score.

SHIB’s Price Analysis

Shiba Inu has consolidated sideways over the past month as its price still trades around the $0.0000168 mark.