The Bitcoin on-chain metrics continue to show bullish signs that a parabolic breakout is imminent for the flagship crypto. The latest of these metrics is a significant turnaround in Bitcoin’s network activity, which could further provide bullish momentum for the crypto token.

Bitcoin Sees Surge In Network Activity

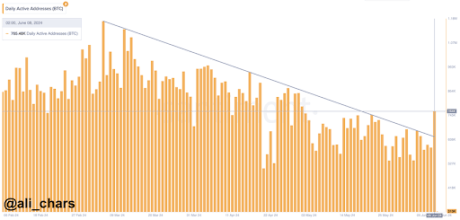

Crypto analyst Ali Martinez revealed in an X (formerly Twitter) post that the number of daily Bitcoin addresses had broken a downtrend that began on March 5. He added that 756,480 Bitcoin addresses have been active in the last 24 hours. Martinez claimed this development is a “positive sign” that Bitcoin’s bull run will continue.

Indeed, this development could trigger a run for Bitcoin as it suggests that more users are returning to the ecosystem. This could positively impact Bitcoin’s price as they continue to trade the flagship crypto. Meanwhile, the surge in daily active addresses adds to a growing list of bullish signals for Bitcoin.

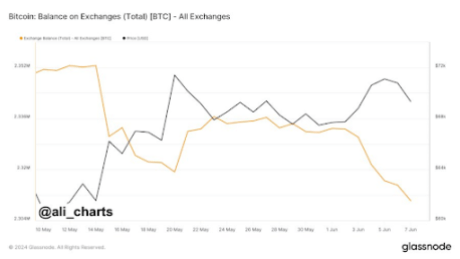

Another bullish signal is the decline of Bitcoin’s supply on exchanges, which recently dropped to new lows. This positive development suggests that Bitcoin investors are holding for the long term rather than looking to offload their holdings anytime soon, which could add significant selling pressure on the flagship crypto.

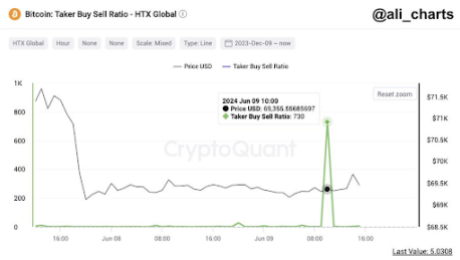

This decline in Bitcoin’s supply on exchanges continued last week, with Martinez revealing that almost 22,647 BTC ($1.57 billion) were withdrawn from crypto exchanges in the past week. Meanwhile, the crypto analyst mentioned that the Bitcoin Taker Buy Sell Ratio on the HTX crypto exchange has surged to 730.

This surge in the buy-sell ratio means that more investors are accumulating the flagship crypto at an impressive rate. Martinez noted that this “massive buy pressure overwhelming bullish sentiment” and a strong upward trend might be on the horizon for Bitcoin. This buy pressure could undoubtedly impact Bitcoin’s price, especially if the selling pressure is low.

Bitcoin’s Current And Future Outlook

Martinez has also provided insights into Bitcoin’s current and future outlook in a series of posts on his X platform. In one post, he noted that Bitcoin’s price is currently situated in a strong support zone between $69,380 and $67,350, where 1.97 million addresses acquired 964,000 BTC. He added that Bitcoin must hold above this level to sustain its bullish momentum.

Meanwhile, the crypto analyst provided insights into how high Bitcoin could rise on its next leg up if it manages to sustain this bullish momentum. He said the next local top for Bitcoin could be around $89,200. Bitcoin is still expected to rise higher than that at some point in the bull run since crypto analysts like Tarekonchain predict that it is very likely that the flagship crypto will rise above $100,000 before it hits its market peak.